The total population of Hong Kong is only about 7.9 million, but more than 3 million companies have been registered, including Tencent and Alibaba Group. Many companies regard Hong Kong as an ideal tax place.

Three Main Types of Taxes in Hong Kong

Three Main Types of Taxes in Hong Kong

01 Property Tax

The property tax rate is 15%, which refers to the tax levied on the rental of land and buildings in Hong Kong.

02 Salaries Tax

Similar to the domestic personal income tax, salaries tax refers to the tax that taxpayers need to pay on income earned by working in Hong Kong.

03 Profits Tax

There is only profits tax for companies in Hong Kong, that is, corporate income tax. Beginning in 2018, 8.25% for profits of HK$2 million and below, and 16.5% for profits of more than HK$2 million.

One of the most important reasons why Hong Kong can become a good choice for many enterprises is that profits tax helps enterprises reduce a lot of tax pressure.

Hong Kong operates a territorial tax system, which only taxes profits generated locally in Hong Kong. If your company is profitable in Hong Kong, you have to pay taxes; If your company is losing money, the money lost can be deducted against the latest year’s profits. For example, a company lost 3.1 million in the past few years, but only earned 3 million this year, so overall it is still not profitable and does not need to pay taxes, and there will still be 100,000 of the amount that can be deducted from profits next year.

Territorial Tax System

The territorial principle makes no distinction between residents and non-residents. If you are a non-Hong Kong resident and your profits come from Hong Kong, you will need to pay profits tax in Hong Kong; If you are a Hong Kong resident, but the profits your company makes come from other locations (e.g. your customers and suppliers are not in Hong Kong), then you do not need to pay the tax.

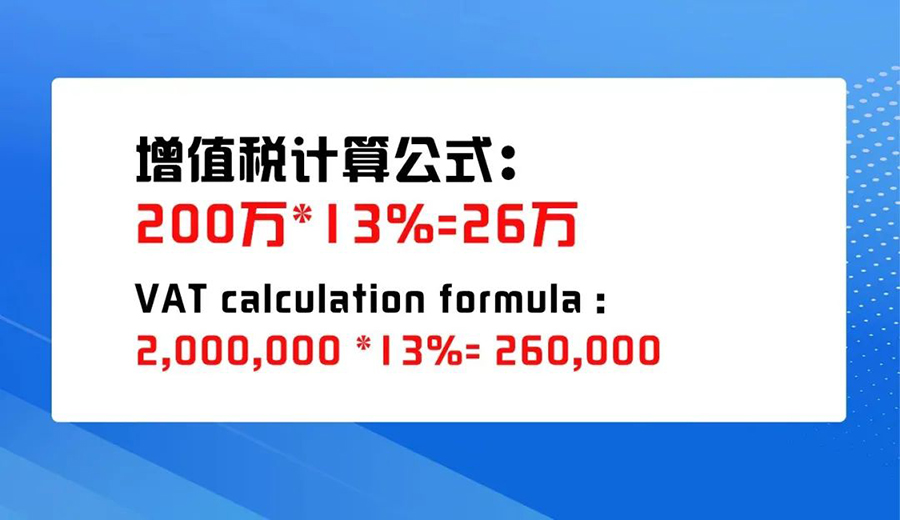

In addition, Hong Kong has no value-added tax and sales tax, and the value-added tax is a major tax for mainland companies. If you are a mainland company, you will have to pay VAT of 260,000 yuan if you earn 2 million yuan; If you are a company in Hong Kong, you will save this fee.

Moreover, Hong Kong also has the advantages of no foreign exchange controls and money transfer flexible, which is also a significant reason why Hong Kong can attract so many enterprises to invest. Although it is attractive to register a company in Hong Kong, you should also choose according to your personal needs~